Photo from Creative Commons

In 2017, the amount of foreign direct investment (FDI) in the Philippines increased at a rapid rate, culminating in the so-called “FDI boom” of Rodrigo Duterte’s presidency. One pundit claims that the foreign direct investment (FDI) boom has little to do with China and more with other foreign investors. Countering his conclusion, I argue that such claims underestimate the amount of increases of Chinese FDI in the country, and more importantly, misconstrues the global structure of foreign capital inflows.

The PRC’s and Hong Kong’s FDI

Depending on the research question, we can either include or exclude Hong Kong from the PRC in calculating inbound investments. Specifically, when comparing the amount of Chinese FDI in the Philippines to that in other states, the difference between Hong Kong and the PRC becomes less important because all the countries are measured by a single standard. Datasets, such as the American Enterprise Institute’s (AEI) Chinese Global Investment Tracker (CGIT), tend to track Chinese FDI after it leaves Hong Kong for other states, while the China’s Ministry of Commerce (MOFCOM) Annual Bulletin of Chinese Outward Investment clearly treats Hong Kong as a separate category. As such, this step becomes the baseline standard for comparing the amount of Chinese FDI. In other words, the overestimation (AEI) and underestimation (MOFCOM) of Chinese FDI will affect all countries in the same way.

However, when examining Chinese FDI in a single country, excluding Hong Kong underestimates the increases of Chinese FDI because the baseline standard no longer exists. In contrast to an inter-state comparison that affects all the units, an inter-investor comparison simply counts the absolute number increase of FDI from all the investors in the world. Here, the increase of Chinese FDI is compared to those of American, Japanese, as well as Hong Kong FDI. A key problem is that this framework assumes that these investors are discrete and thus independent from each other. But this is not the case due to the complexities of the global financial system. Specifically, capital-exporting states with controlled financial systems tend to channel their economic capital into small intermediaries, who then manage the capital for financial and marketing purposes, before reinvesting it somewhere else. In other words, the comparison of absolute FDI increases in a single state will lead to systematically biased results because capital-exporting states and intermediaries are seen as similar units. In empirical terms, a surge of FDI from Hong Kong occurring alongside the marginal increase of the PRC’s FDI obscures the overall amount since the latter channels its capital through the former. Furthermore, treating the surge of Hong Kong FDI as if it were another state conceals the political impact of any country’s economic relations with China.

In the case of the Philippines, the Central Bank of the Philippines indicates that during the Benigno Aquino III administration (2010 Q3-2016 Q2), the PRC’s FDI inflows amounted to US$51.321 million while that of Hong Kong aggregated to $1180.75 million. Similarly, in the one and a half years of Duterte’s term (2016 Q3-2017), PRC’s inflows reached US$ 37.00 million but those of Hong Kong aggregated to US$683.51 million. While these numbers seem to disappoint initial expectations, PRC inflows during the Duterte administration already comprise more than 2/3 of comparable inflows of the entire Aquino administration. In sum, it is a crucial methodological mistake to separate the two without paying attention to Hong Kong’s important economic role for the PRC.

The Offshore Intermediary

To explain Hong Kong’s role as a financial intermediary, this analysis turns to the PRC’s development strategy. Specifically, the PRC relies on three methods to boost its economic growth: wage-repression, the artificial devaluation of the renminbi, and financial repression. Of these three mechanisms, financial repression is the most important mechanism. Specifically, financial repression occurs through a series of monetary policies administered by the People’s Bank of China (PBC) which transfers wealth from Chinese households to subsidize producers, infrastructure investors, and real estate developers. To maintain financial repression, the PBC needs to maintain control of the renminbi, restrict its convertibility, and ignore the signals of the global market. Because of these strict controls, PRC enterprises and capitalists tend to send their capital to Hong Kong to protect their savings from the shocks of state intervention, pool their funds, and take advantage of professional services for reinvestment. In a process that analysts call “double dipping,” PRC firms also go to Hong Kong in the capacity of a “foreign investor,” changing their registration before reinvesting back in mainland China to take advantage of the privileges given to global, non-PRC firms.

While capitalist firms from countries across the world pool their money in safe havens, such as the British Virgin and Cayman Islands, Hong Kong acts as a special intermediary for China. Indeed, the PRC’s control of Hong Kong’s political sovereignty and the collusion of Hong Kong business elites with the CCP make it more reasonable to group Hong Kong and the PRC altogether when it comes to FDI outflows. There are non-PRC firms and money in Hong Kong, but these are in the minority since the majority of investors in Hong Kong come from the PRC. Even without closely examining Hong Kong companies one by one, the PRC, as the largest investor of Hong Kong, and the inseparable political-economic connections of the two, makes it reasonable to conclude that the PRC channels its FDI through Hong Kong. Indeed, this separation between Hong Kong and PRC has been one of the main motivations for the AEI to create the Chinese Global Investment Tracker (CGIT) dataset in order to track the PRC’s FDI after it leaves Hong Kong. In 2015, MOFCOM data indicates that 59.8% of the PRC’s outbound FDI went to Hong Kong. Similarly, the Hong Kong Trade Development (HKTD) Council estimates that around 60% of the PRC’s FDI goes through Hong Kong before entering the developing world.

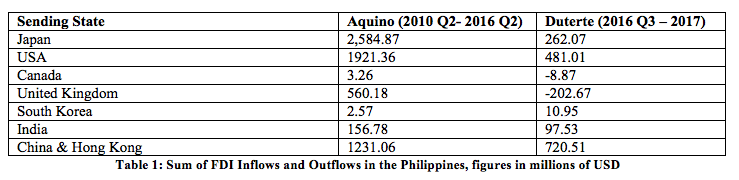

Understanding Hong Kong’s importance to the PRC’s FDI makes a crucial difference. As Table 1 demonstrates, adding Hong Kong to the PRC’s FDI changes the broader FDI outlook of the Philippines. Above and beyond the government-to-government projects or large state investments, there is variation among Chinese investment activity in terms of asset specificity, sectoral distribution and investment size. There is no singular characteristic “Chinese investor.” Instead, there is a multiplicity of regional state-owned enterprises, provincial entrepreneurs and private investors. As I argued in a recently published paper, the institutional inertia of Arroyo and Aquino’s administrations led to the increase of smaller yet vastly more numerous Chinese private investments. Many of these businesses go through Hong Kong to invest in the numerous Investment Promotion Zones (IPZ) across the country.

Source: BMP6 Dataset of the Central Bank of the Philippines’s Data1

Competitive Dynamics of Different Investors in the Philippines

The increases of US, Japan, and European FDI in the Philippines should not be a surprise. Because of historical path dependency, the changing features of the global economy, and the threat of China’s political-economic advancement in the Philippines, these increases should be seen as expected outcomes. First, previously existing foreign investors will have the advantage of increasing their FDI stock in the host state due to their capacity to project power to the numerous elite networks and already existing structural power. FDI during the colonial and post-colonial period created enclaves for foreign investors to work with the national enterprises of many countries in the developing world.

The same pundit wrongly compared Japanese and Chinese FDI, arguing that the former has exceeded the latter by 20-to-1. This reveals a limited understanding of how foreign businesses, financing, and path dependency works. Some of these foreign investments are tied to development projects assisted by infrastructure loans by the Japanese International Cooperation Agency (JICA). These foreign investment ventures and infrastructural projects were discussed during the previous administrations, making their continuation and completion during the Duterte administration unmeaningful. For instance, the Manila-Clark Railway project, which recently begun in January 2018, grew out of the Clark Railway Project during the Aquino administration. However, Japan’s interest and role in funding this specific project begun as early as Fidel Ramos (1992-1998) and Joseph Estrada’s presidencies (1998-2001)

In contrast, the PRC is attempting to enter more controversial sectors monopolized by key oligarchs and targeting more contentious geographies. Comparing Japanese infrastructural FDI in flood control, road construction, and previously discussed projects to the PRC’s plans of adding a third player in the telecommunication sector, or constructing a railway in the most impoverished area in the Philippines leads to biased results because of the different starting points and varying difficulties of investing. Japan’s most comparable infrastructural project, the Metro Manila Subway, was recently signed last month and has yet to start. In other words, unless the confounding factors are properly controlled for, comparing Chinese and Japanese FDI and infrastructural investment in different sectors is unscientific.

Second, FDI of Japan, United States, and Europe will continue to increase, but it is difficult to meaningfully compare Chinese FDI to those of other investors in absolute numbers. Because the amount of capital worldwide continues to increase, comparison of the different sources of FDI will need to be adjusted accordingly. For instance, if the total amount of American global FDI stock in 2015 was $6.1 trillion, and China-Hong Kong was only $2.5 trillion, it is necessary to “weigh” both FDIs, as the Philippines can more likely acquire the American FDI at three times the rate than the latter.

And third, Duterte’s rapprochement with the PRC should not only be taken as the simply the effect of Chinese political and economic policies toward the Philippines. Examining the pivot in a more relational perspective reveals a multiplier effect, whereby the likelihood of China’s capacity to invest in the Philippine economy emboldened these other investors to increase their offers. In the absence of competing investments, these investors can simply offer the minimum level of investment or benefit to the Philippine government. However, the existence of the PRC as an alternative investor to the Japanese, American, and European capitalists, who usually cooperate with one another to take advantage of the host state, has inadvertently led to the increase of the Philippines’ bargaining power. The rapid rise of FDI from the American, Japanese, and European governments could be better interpreted in this way rather than simply from their motivations to profit.

1 BMP6 uses the asset and liability principle, whereby the claims and liabilities of the foreign affiliate from its local companies or partners are presented as “reverse investment” or divestment.

Alvin A. Camba is a Doctoral Candidate in Sociology at Johns Hopkins University. He uses mixed-methods approaches to derive the determinants of [Chinese] foreign direct investment, the dynamics of elite competition, and the political-economic effects of capital mobility on the developing world. He has been awarded the Terence K. Hopkins Best Graduate Student Paper Award (honorable mention) from the American Sociological Association (ASA), the Postdoctoral and Graduate Student Publication Research Award (honorable mention) from the Critical Realism Research Network, and the pre-Dissertation fellowship from the Southeast Asian Research Group (SEAREG).